Text-to-Speech Market Size, Share, Trends and Growth Analysis 2032

Updated on : October 23, 2024

Text-to-Speech Market Size & Growth

The global Text-to-Speech market size is expected to be valued at USD 4.0 billion in 2024 and is projected to reach USD 7.6 billion by 2029; growing at a CAGR of 13.7% during the forecast period from 2024 to 2029.

The text-to-speech market is experiencing growth driven by the rising need for AI-based tools, natural language processing, and the widespread adoption of advanced electronic devices. However, challenges surrounding clear pronunciation and voice modification are impeding market advancement. Despite these hurdles, opportunities emerge from the increasing demand for mobile devices, augmented government spending on education for differently-abled students, and the growing population facing diverse learning difficulties. A significant trend in the text-to-speech market involves the expected upsurge in demand fueled by progress in digital content development, the prevalent use of handheld devices, and the expanding reach of internet connectivity.

Text-to-Speech Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Text-to-Speech Market Trends and Dynamics:

Driver: Increased government spending on education of differently-abled students

The growth of the Text-to-Speech market is fueled by a notable driver: the augmented government expenditure on the education of differently-abled students. This trend is contributing to an escalating demand for Text-to-Speech solutions within educational settings. As educational institutions strive to create more inclusive learning environments, Text-to-Speech technology is playing a pivotal role by providing accessible tools for individuals with visual or learning impairments. This facilitates the dissemination of information through spoken text, ultimately enhancing the educational experience for a diverse range of students.

Restraint: Growing privacy, security, and ethical concerns in cloud-based Text-to-Speech

Despite the optimistic growth trajectory of the Text-to-Speech market, a noteworthy restraint is arising due to heightened concerns in the realms of privacy, security, and ethics associated with cloud-based TTS applications. As TTS solutions rely increasingly on cloud infrastructure, users and organizations are becoming more cautious about potential risks and vulnerabilities. The concerns span a range of issues, including the fear of data breaches, where unauthorized access to sensitive information could occur, and apprehensions about the potential misuse of personal or confidential data processed by these cloud-based systems. To mitigate these concerns, it is imperative for developers and providers of cloud-based TTS applications to implement robust security measures.

This includes encryption protocols to safeguard data during transmission and storage, rigorous access controls to limit unauthorized entry, and adherence to ethical standards in data usage and handling. Proactive transparency about data practices, compliance with privacy regulations, and continuous improvement of security protocols are essential to reassure users and organizations, fostering trust and ensuring the sustained adoption of cloud-based Text-to-Speech solutions in the market.

Opportunity: Integration of Text-to-Speech in autonomous vehicles

An exciting prospect for the Text-to-Speech market lies in the increasing integration of TTS technology into autonomous vehicles. With the automotive industry progressing towards autonomous and connected vehicles, there is a growing demand for sophisticated voice interfaces that can enhance user experience and safety. Text-to-speech systems are becoming integral in providing natural and contextually relevant voice communication within the vehicle environment. This includes delivering navigation prompts, enabling hands-free calling, and facilitating other interactive features. The integration of TTS in autonomous vehicles not only responds to the demand for advanced in-car communication but also positions Text-to-Speech providers at the forefront of contributing to the evolution of smart and user-friendly automotive technologies.

Challenge: Creating a comprehensive acoustic database for Text-to-Speech

A substantial hurdle confronted by the Text-to-Speech market is the intricate task of developing a generic acoustic database that can effectively cover the extensive array of language variations. The quest for achieving natural-sounding speech synthesis across diverse linguistic contexts necessitates the creation of comprehensive databases that encompass not only different languages but also various accents, dialects, and regional nuances. This poses a formidable challenge as it demands ongoing efforts to update databases continuously, accommodating the dynamic evolution of language patterns and the ever-expanding global linguistic diversity. The significance of overcoming this challenge cannot be overstated.

The authenticity and naturalness of synthesized speech are directly contingent on the richness and accuracy of the underlying acoustic database. Text-to-speech providers must grapple with the complexities of capturing the subtleties inherent in diverse linguistic expressions to deliver solutions that resonate authentically with users across a spectrum of cultural and linguistic backgrounds. Successfully addressing this challenge not only enhances the quality of Text-to-Speech offerings but also ensures their relevance and effectiveness in a global context, where linguistic diversity is a fundamental aspect of human communication.

Rf-Over-Fiber Market Ecosystem

The Text-to-Speech market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Microsoft Corporation (US), Google (US), Amazon.com, Inc. (US), IBM (US), and Baidu Inc. (China).

Services by offering is expected to hold the highest market share during the forecast period.

Services holds the largest share in the Text-to-Speech market offering category due to the heightened demand for cloud-based TTS solutions and the shift toward service-oriented models. The versatility and scalability of TTS services enable businesses to access advanced voice synthesis capabilities without the need for substantial infrastructure investments. Cloud-based offerings, in particular, provide a cost-effective and efficient way for organizations to integrate TTS into their applications and products.

The subscription-based nature of TTS services ensures continuous updates, improved customization options, and simplified maintenance, appealing to businesses seeking hassle-free and up-to-date solutions. As the market emphasizes accessibility, flexibility, and seamless integration, TTS services emerge as a pivotal and dominant offering, catering to the evolving needs of a wide range of industries.

Based on deployment, Cloud-based to hold the highest CAGR during the forecast period

Cloud-based deployment is experiencing a high CAGR in the Text-to-Speech market due to its inherent advantages aligning with contemporary business demands. Cloud solutions offer unparalleled scalability, allowing organizations to dynamically manage resources based on fluctuating demands without hefty upfront investments in infrastructure.

The cost-effectiveness of cloud deployment is particularly attractive to businesses seeking efficient and budget-friendly solutions, especially smaller enterprises. Additionally, cloud-based Text-to-Speech services facilitate seamless updates and maintenance, ensuring users consistently access the latest advancements in voice synthesis technology. As the business landscape increasingly prioritizes flexibility, rapid implementation, and resource efficiency, the growth of cloud-based deployment in the market reflects its ability to meet these evolving demands and drive widespread adoption.

Large enterprises in Text-to-Speech market to hold the highest market share.

Large enterprises dominate the Text-to-Speech market based on organization size due to their substantial resources, comprehensive infrastructure, and sophisticated technological needs. These organizations often require scalable and feature-rich solutions to meet diverse and complex requirements across various sectors. Large enterprises can invest in and deploy robust Text-to-Speech systems seamlessly, integrating them into their extensive networks and applications.

The need for advanced communication tools, customer engagement platforms, and interactive applications in sectors such as customer service, e-learning, and entertainment drives the demand for high-quality Text-to-Speech solutions. The financial capacity and expansive operational scale of large enterprises position them as key contributors to the adoption of sophisticated and tailored Text-to-Speech technologies, securing their prominence in this market segment.

Based on verticals, the education sector in Text-to-Speech market accounts for highest CAGR

The education sector is experiencing a high CAGR in the Text-to-Speech market due to the increasing recognition of its transformative impact on learning experiences. Text-to-speech technology has become instrumental in addressing diverse learning needs, catering to students with visual impairments, reading difficulties, or those who benefit from auditory reinforcement. The implementation of TTS in educational materials and e-learning platforms enhances accessibility, making content more inclusive for all students. As digital learning gains prominence, educational institutions are leveraging TTS for providing interactive and personalized content delivery. Additionally, the growing awareness of diverse learning styles and the emphasis on inclusive education contribute to the rising adoption of Text-to-Speech solutions, position.

Text-to-Speech Industry Regional Analysis

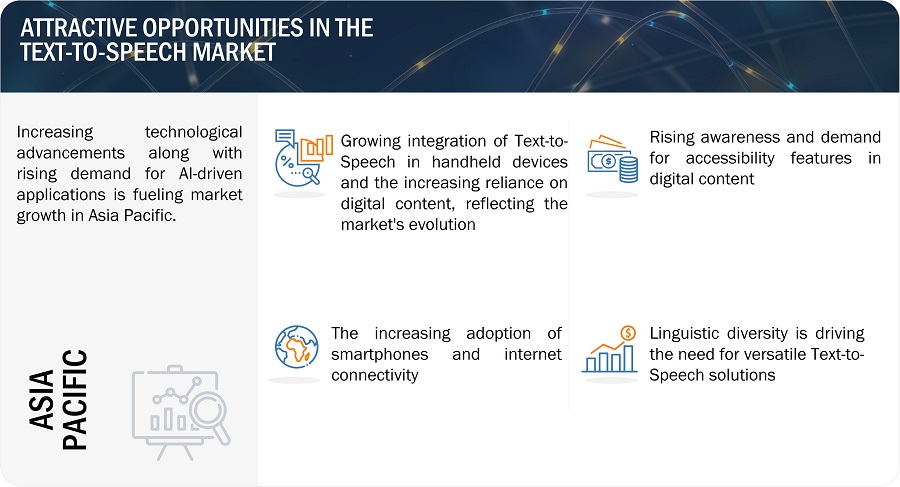

Text-to-Speech market in Asia Pacific region to exhibit highest CAGR during the forecast period

The Asia Pacific region is witnessing the highest CAGR in the Text-to-Speech industry, propelled by several factors. The region is undergoing rapid technological advancements and digital transformation, with a burgeoning population of tech-savvy consumers. The increasing adoption of smartphones, rising internet penetration, and a growing demand for voice-enabled applications in diverse industries contribute to the heightened growth. Additionally, the linguistic diversity across Asia Pacific necessitates versatile Text-to-Speech solutions, catering to a wide array of languages and dialects. As businesses and consumers alike in the region recognize the value of voice technology, coupled with the expanding need for accessibility features, the Text-to-Speech market in Asia Pacific is experiencing robust growth, making it a pivotal player in the global landscape.

Text-to-Speech Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Text-to-Speech Companies – Key Market Players

The Text-to-Speech companies is dominated by players such as

Text-to-Speech Market Report Scope

| Report Metric | Details |

| Estimated Market Size | USD 4.0 billion in 2024 |

| Expected Market Size | USD 7.6 billion by 2029 |

| Growth Rate | CAGR of 13.7% |

| Market size available for years | 2020-2029 |

| Base year considered | 2023 |

| Forecast period | 2024-2029 |

| Forecast units | Value (USD Million/Billion) |

| Segments Covered | By Offering, By Deployment Mode, By Voice Type, By Organization Size, By Language, and By Vertical. |

| Geographies covered | North America, Europe, Asia Pacific, and Rest of the world (RoW) |

| Companies covered | The major market players include Microsoft Corporation (US), Google (US), Amazon.com, Inc. (US), IBM (US), and Baidu Inc. (China). (A total of 25 players are profiled) |

Text-to-Speech Market Highlights

| Segment | Subsegment |

| By Offering |

|

| By Deployment Mode | |

| By Voice Type |

|

| By Organization Size | |

| By Language |

|

| By Region |

|

Recent Developments in Text-to-Speech Industry

- In November 2023, Microsoft has introduced the public preview of Azure AI Speech, a technology enabling users to generate talking avatar videos through text input and develop real-time interactive bots utilizing human images.

- In January 2023, Microsoft has unveiled VALL-E, an innovative language model approach for text-to-speech synthesis (TTS). This method utilizes audio codec codes as intermediate representations and has the capability to replicate an individual’s voice after analyzing a mere three seconds of audio recording.

- In January 2023, Amazon Polly introduces two additional voices for US English support: Ruth, a new neural female voice, and Stephen, a new neural male voice. This expands the portfolio for this locale to include a total of six female voices and four male voices.

- In October 2023, IBM has announced the acquisition of Manta Software Inc, a data lineage platform. This strategic move enhances IBM’s capabilities across watsonx.ai, watsonx.data, and watsonx. governance, empowering businesses to create products grounded in principles of trust and transparency

- In March 2022, Microsoft Corp declared the successful finalization of its acquisition of Nuance Communications Inc. a frontrunner in conversational AI and ambient intelligence spanning various industries, including healthcare, financial services, retail, and telecommunications

- In December 2020, Watson Discovery is an AI-powered intelligent search and text analytics technology that breaks down data silos and finds information hidden deep within corporate databases. The platform employs cutting-edge, market-leading natural language processing solutions to extract relevant business insights from documents, webpages, and large data, reducing research time by up to 75%.

Frequently Asked Questions (FAQs):

What are the Text-to-Speech market’s major driving factors and opportunities?

The Text-to-Speech market is driven by increasing demand for AI-based tools and natural language processing, widespread adoption of advanced electronic devices, and growing applications across industries. The rising need for accessibility features, particularly for differently-abled individuals, fuels market growth. Technological advancements, such as enhanced pronunciation and voice modification capabilities, contribute to the expanding use of Text-to-Speech solutions. Furthermore, the surge in demand for mobile devices, coupled with increased government spending on education, presents additional opportunities for market expansion.

Which region is expected to hold the highest market share?

North America commands a larger share of the Text-to-Speech market due to its highly developed technological landscape, including major players in the IT and software industry. The region’s early adoption of artificial intelligence (AI) and natural language processing (NLP) technologies contributes to the robust ecosystem for voice synthesis. The prevalence of English as a primary language further solidifies North America’s dominance, with a vast market for English language models. Additionally, the region’s focus on technological innovation, coupled with a tech-savvy consumer base, positions North America at the forefront of Text-to-Speech market leadership.

Who are the leading players in the global Text-to-Speech market?

Companies such as Microsoft Corporation (US), Google (US), Amazon.com, Inc. (US), IBM (US), and Baidu Inc. (China) are the leading players in the market. Moreover, these companies rely on several strategies, including new product launches and developments, collaborations and partnerships, and acquisitions. Such strategies give these companies an edge over other players in the market.

What are some of the technological advancements in the Text-to-Speech market?

Technological advancements in the Text-to-Speech market are marked by the evolution of AI-driven tools, fostering more natural language processing capabilities. Continuous improvements in voice synthesis enhance the lifelike quality of generated speech. Pronunciation clarity and voice modification technologies are advancing, addressing previous challenges. Moreover, the integration of TTS in various applications, from navigation devices to virtual assistants, reflects the ongoing innovation driving the market forward.

What is the size of the global Text-to-Speech market?

The global Text-to-Speech market was valued at USD 4.0 billion in 2024 and is anticipated to reach USD 7.6 billion in 2029 at a CAGR of 13.7% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Source link